This is known as a "buy and hold" strategy. One popular strategy is to buy when the short-term average crosses above the long-term average and sell when it crosses below. There are many different ways to use an ema cloud system to execute better in the markets. Green clouds are bullish and red clouds are bearish. Conversely, it is a downtrend when the short-term average is below the long-term average, which the cloud color can also indicate. For example, when the short-term average is above the long-term average, it is a sign of an uptrend. They are also used to measure the strength of a trend. This can be helpful when trying to play momentum with a bearish bias on any timeframe. The ema cloud area serves as resistance levels to watch for a better risk to reward.

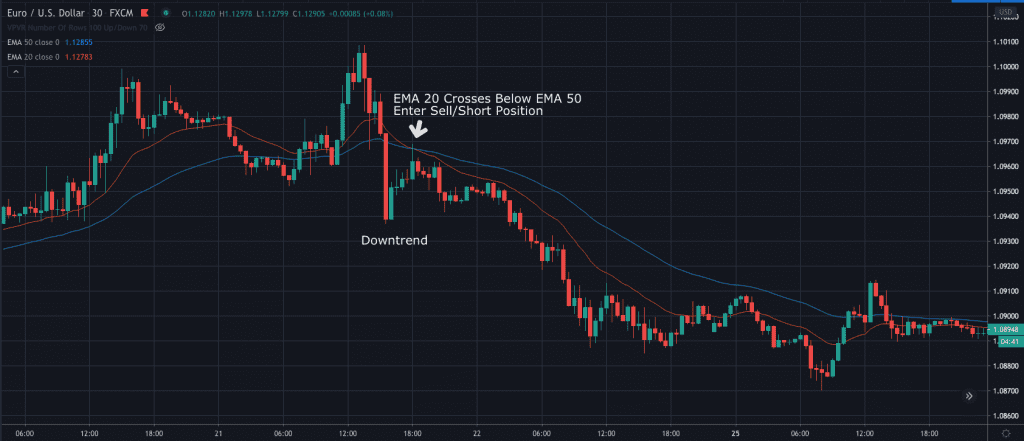

Again, dozens of touches lead to continuation. As well as entering in the direction during support and resistance touches on the cloud. It is common to use these clouds to gauge the market trend currently. A chart example below had a cloud crosses from green fill to red fill, signaling the end of the bullish run and the beginning of a possible bearish trend.ĮMA clouds can be utilized effectively to identify stock entry and exit points. This concept implies that it could be an excellent time to play a reversal or take profit as a trader. When the two EMAs cross, this will change the cloud color fill and indicate a change in momentum. Most momentum traders will play the trend based on the cloud color. A green ema cloud is bullish while a red ema cloud is bearish. The trading concept still applies even on a different platform. Just like Tradingview the settings for the indicator can be changed and colors adjusted to your liking. Once added you should see the EMA cloud on your chart like the example below. Make sure your Thinkorswim platform is not running when you click "view in Thinkorswim".In order to add this popular trading study, all you have to do is follow the instructions below. Luckily, a study for the Ripster EMA cloud was released and can be added to Thinkorswim as well. There are not many platforms that support EMA clouds for charting and trading.

#Ema trading how to

How to Add Ripster Ema Clouds to Thinkorswim

#Ema trading code

These settings visually show just how simple this indicator is and how it is possible to recreate the source code if needed for other trading platforms. You are welcome to customize any inputs for your two desired emas.īy seeing the settings, you can see EMA cloud 2 is created using the 5 EMA short length and 13 EMA long length, and the EMA cloud 3 is created using the 34 EMA short length and 50 EMA long length. Pulling this up, you can see the details on the inputs. If you are interested in removing certain clouds, please double-click the clouds or tap the gear icon on the top left next to the indicator. Of course, you’re welcome to experiment with the other clouds, but from my experience cloud, two and cloud three have fewer false signals, a fluid trendline for day traders, and better cross confirmation. The most popular cloud will be cloud number two, and the second most popular cloud will be cloud number three. If you were to add the clouds to your screen right now, you would see five clouds. Although we cannot know how long this will last, enjoy it while you have it.

#Ema trading free

The quickest way to add the EMA cloud is, under the name “Ripster EMA Clouds.” Other platforms could add this indicator with one script, but this is the most popular trading system and most common (more importantly, free to use). This fill area allows an entry at possible support or resistance and presents a fluid trendline.Īdding EMA cloud system to your technical analysisĬurrently, you won't be able to find this indicator easily through google. The ema cloud area is found by the color fill between the slow and fast EMAs, as the chart below shows. This can be seen in the example below, where the top of the cloud is created from the fast ema, in the bottom of the cloud is made from the slow ema. They are formed by plotting two exponential moving averages, one short-term (fast) and one long-term (slow), and then filling the area in between the two moving averages. EMA (exponential moving average) clouds are a technical analysis tool used to identify a possible trend direction or reversal.

0 kommentar(er)

0 kommentar(er)